In the world of investment and wealth preservation, bullion has endured as a safe-haven asset and solid store of wealth. But what is bullion? Whether gold, silver, platinum, or palladium, these precious metals have always been valued for their intrinsic qualities and staying power. If you are new to precious metals investing and want to learn the basics of bullion or gain a further understanding of the investment, this guide will walk you through the basics to get you started on your journey.

What is Bullion?

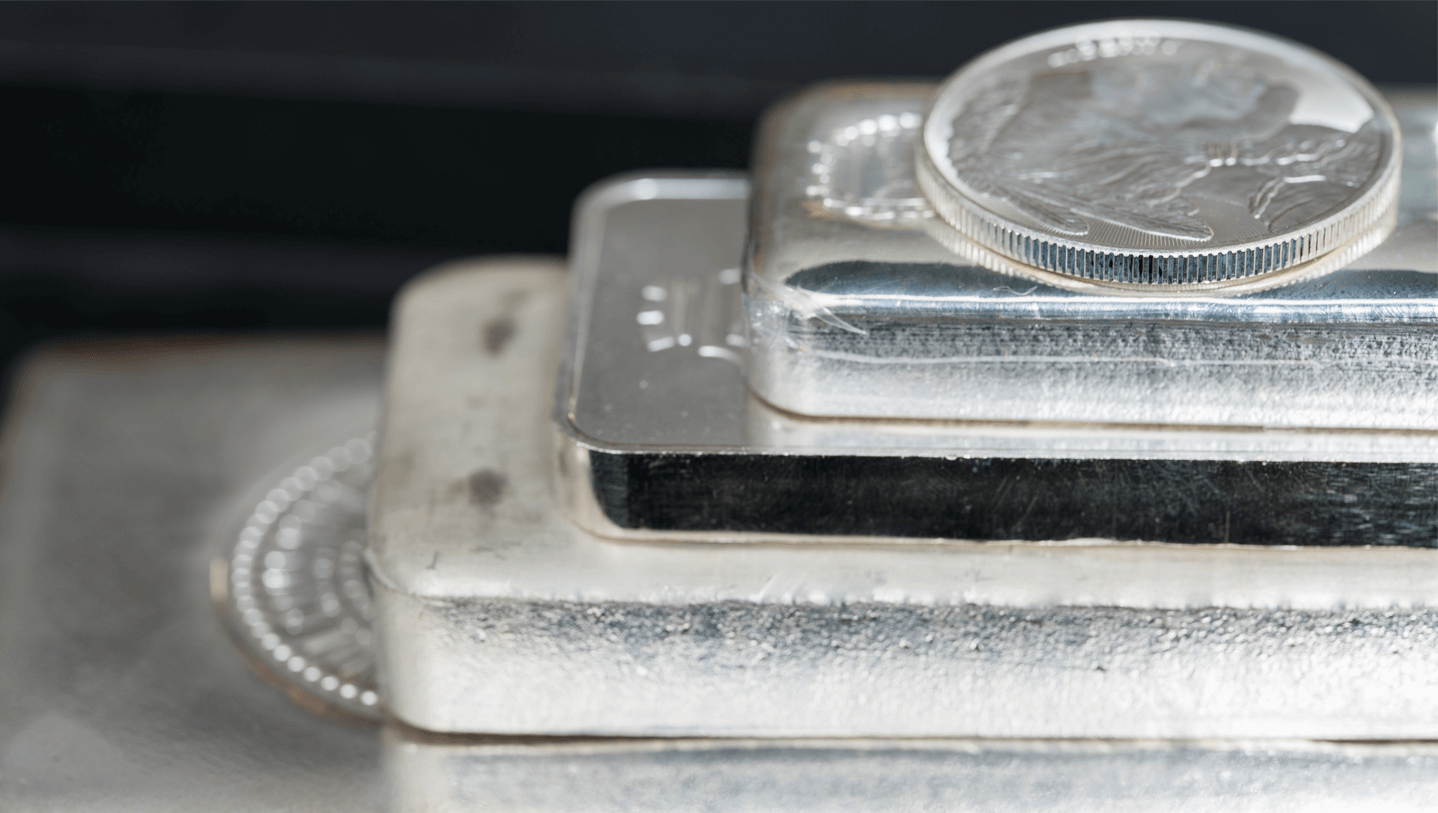

Bullion, at its core, refers to precious metals that are taken out of the ground, refined to (typically) 999 fine pure metal, and manufactured into bars or coins. Unlike paper currency, which is printed on worthless paper and backed solely by the faith of the government, bullion’s worth greatly lies in its inherent metallic properties. What is bullion used for? Most who purchase bars or coins made of precious metals do so for the sole purpose of investment, but what makes them a desirable investment is partly due to the other uses of the underlying metal.

Why Invest in Bullion?

Bullion serves multiple purposes to investors and is a great addition to a balanced portfolio. Because precious metals have proven to retain their value over long periods of time, they have become known as a reliable hedge against inflation and economic instability. They are a safe, predictable asset with a strong upside potential for growth. They act to diversify and spread risk across different asset classes. An individual with investments solely in stocks is open to huge losses in the case of market volatility. By owning bullion, you are protecting yourself from those unpredictable swings.

Another extremely beneficial upside to owning bullion is the liquidity of the metal. There are many bullion exchanges and bullion trading stores in nearly every city in America. The heavy and consistent demand of bullion coins and bars means that when you are ready to sell your investment, you can get an extremely competitive price and be able to liquidate an unlimited quantity of your investment instantly. There will always be buyers for popular coins and bars willing to pay 98-99% of the melt value, making this asset exceptionally useful when funds are needed quickly in case of an emergency. Finally, unlike stocks and bonds, precious metals are tangible assets. This means you can physically hold and possess this investment, safe from the manipulation of banks or other governing bodies. It makes it significantly harder to manipulate the price.

What are the different types of bullion?

1. Gold Bullion

For thousands of years, gold has been a symbol of wealth and prestige. A long history of value, combined with the desirable traits of the metal itself, has made the yellow metal the most popular option when investing. Pure gold does not tarnish over time and has extremely high conductivity. This has made it useful in electronics and jewelry. Industrial uses and jewelry manufacturing serve as a way to ensure there will always be additional demand aside from just investing. When buying gold bullion, there are a few popular options. The most common gold coins are the United States Gold Eagle, Canadian Maple Leaf, and South African Krugerrand. You can also buy gold in the form of bars in varying weights. Generally made by private companies like PAMP Suisse, Credit Suisse, Valcambi, and others, there have been a few governments that have produced official bars, including Canada and Great Britain.

2. Silver Bullion

At approximately 1/80 the price of gold, silver used to be referred to as the “poor man’s gold” but has in recent years become extremely popular, even with large institutional buyers. Like gold, silver has additional industrial uses, which serve to prop up the value in addition to the investors. If you believe electric cars will continue to be popular around the world, silver is a component in the massive batteries needed to power them. Popular silver coins include American Silver Eagles, Canadian Maple Leaves, British Britannias, and Austrian Philharmonics. You can also go with silver bars, typically made by private companies, but occasionally governments put out their own brands as well.

3. Platinum and Palladium Bullion

Although much rarer than gold and silver, platinum and palladium are far less popular as an investment. Previously, they were significantly more expensive per ounce but have since plummeted in value to nearly 1/3 the price of gold. They are more susceptible to broad market forces like catalytic convertor demand, and much less driven by investment demand. There is significant volatility in these markets, and generally less recommended by advisors.

How to Buy Gold Bullion

Many new investors are wondering how to buy gold safely and cost-effectively. The most popular way you will find in most bullion buying guides is to stick with physical bullion. There is a saying that if you don’t hold it, you don’t own it. Relying on ETFs (essentially stocks that mimic the price of gold) carries increased risks due to the fact you are only buying ones and zeros on a computer screen. Going to a physical bullion exchange store and paying an extra percent is easily worth it, as there will always be an increased demand for the actual product. We also strongly recommend sticking with plain bullion and not spending the extra money on collectible coins unless you plan on becoming a true coin collector. You will almost certainly not get as good of a return on your investment in the long run!

Just having a beginner's knowledge of the bullion market can be dangerous. Find a local dealer who you can trust and ask questions! It is important to learn what bullion is, what collectible coins are, and the differences between the two. Most honest dealers will be more than happy to explain how the bullion market works, how much gold bullion weighs, and answer any other questions you may (and should!) have.

Ready to start your journey into the world of bullion? Explore our selection and begin building your precious metal portfolio today! Contact Edelman’s today for more information about gold and silver bullion.